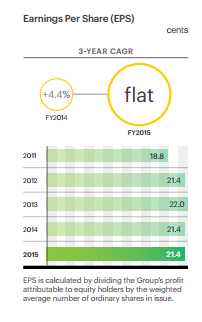

M1 released its 2016 full year earnings with a 16.1% decline to $0.16 per share from $0.19 per share. The market reacted sharply with a 5.5% decline in share price from $2.17 to close at $2.05.

|

| M1 declined 5.5% to close at $2.05 after the earnings were announced |

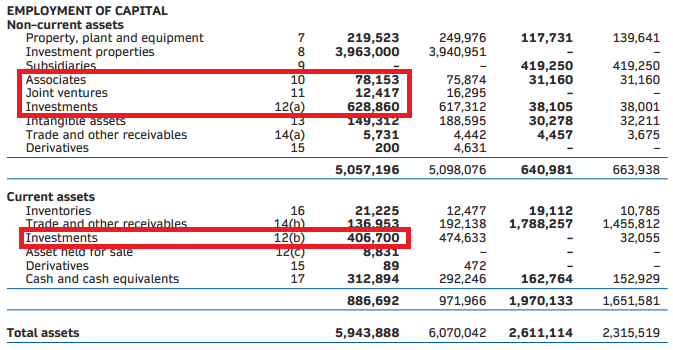

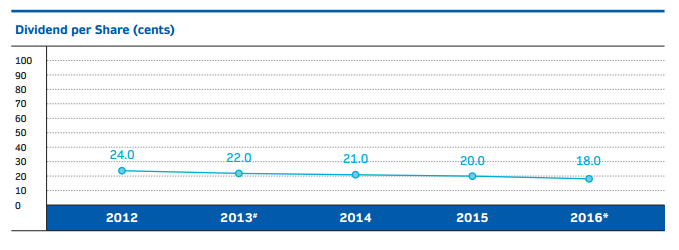

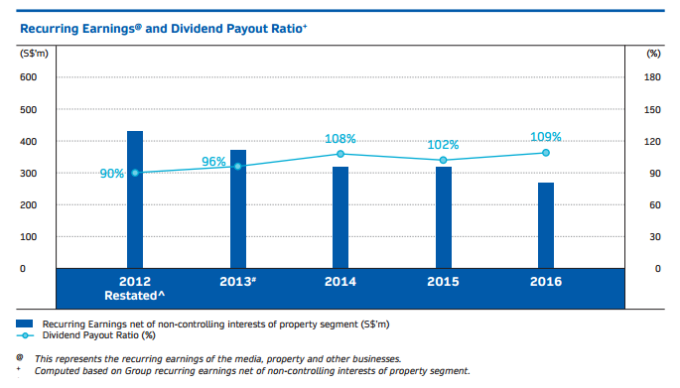

Attractive dividend yield?

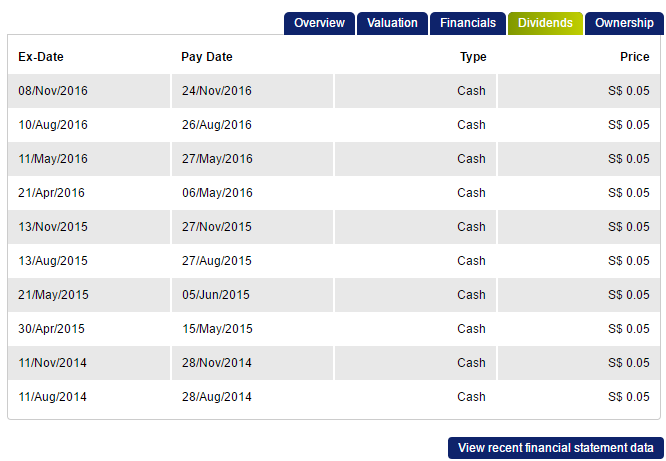

Dividends decreased in line with earnings. 2016 full dividend of $0.129 was 15.7% correspondingly lower than 2015 final dividend of $0.153. Payout ratio was maintained 80.5%, in line with M1's dividend policy. At current price of $2.05, this works out to a dividend yield of 6.3% which is pretty decent for a blue-chip. The big question here is the sustainability of the the earnings (and hence, the dividends). To understand this, let's understand what's driving the decline and the nature of the driver (whether it is permanent or temporary).

|

| FY16 full year dividends declined in line with full year earnings |

Source of earnings decline

The decline in full year earnings was $28.8 m (from $178.5 m to $149.9 m).

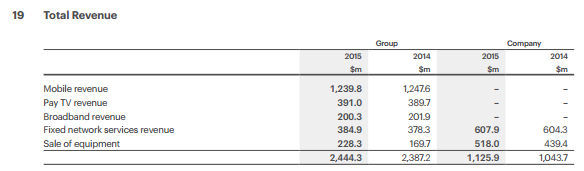

In M1's presentation slides, Handset Sales Revenue was shown to have declined a staggering 23.7% or $80 m. Given that Handset Sales made up more than 30% of Total Revenue, it may be intuitive to attribute the entire decline in earnings to Handset Sales, which are discretionary consumer purchases.

This appears to be supported by the fact that core recurring Service Revenue remains intact. Since the decline in earnings appears to be temporary, then this would look like an attractive buy given the yield, right? Not necessarily.

|

| It is intuitive to attribute earnings decline to Handset Sales given the heavy weighting of Handset Sales |

Temporary earnings decline?

The decline in Handset Revenue was offset by a corresponding 17.9% decline in Handset Cost of Sales of $75 m. This means that the decline in Handset Sales actually contributed to only $5 m out of the $28.8 m decline in earnings. Where is the remaining $23.8 m decline in earnings coming from?

|

| Decrease in Handset Sales accompanied by decrease in Handset Costs; Increase in cost of fixed services by $7 m |

Higher recurring expenses

$7 m comes from the increase in costs from providing fixed services (see above chart), $9 m comes from the increase in depreciation & amortisation expenses, while $4 m comes from increase in Facilities expenses. All of these expenses are recurring in nature.

|

| Depreciation & amortisation expenses increased $9 m; Facilities expenses increased $4 m |

Future outlook

To summarise, 70% (or $20 m ) of the $28.8 m decrease in earnings appears to be from higher recurring costs which are here to stay. It is unlikely that earnings would increase as a result of reversal of these costs.

In this writer's opinion, higher core recurring Service Revenue to improve earnings appears unlikely due to stable market dynamics and potential market share disruption from the entrance of 4th telco. Higher capex and investments in infrastructure to explore future opportunities as outlined by M1's future strategy is likely to increase recurring costs and further erode earnings (and hence dividends).

|

| Expect higher investments and capex as part of M1's strategy |

Investors looking to lock in the 6.3% dividend yield at the current price of $2.05 may have to brace themselves for more to come.